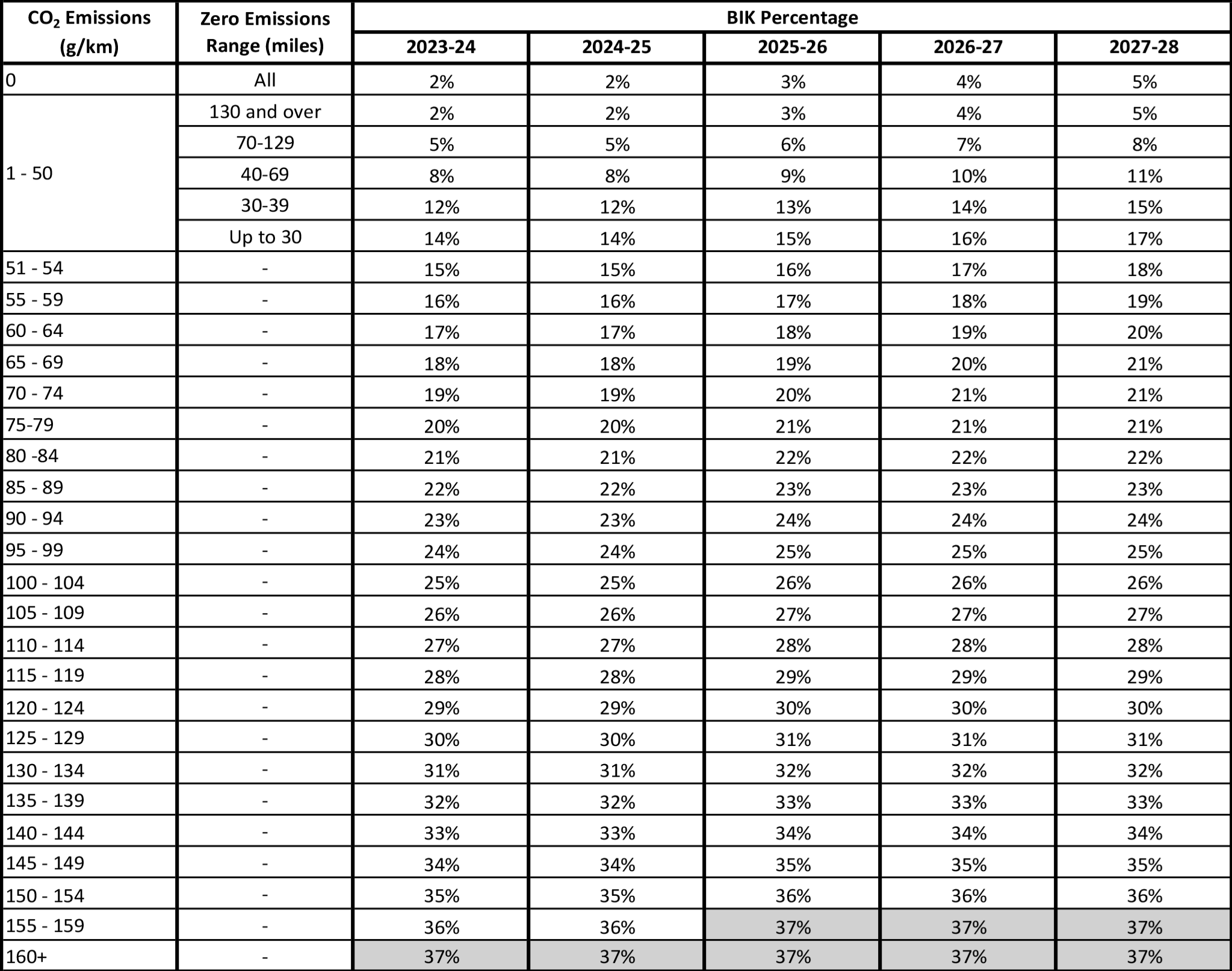

Company car tax BIK rates 2023/24 to 2027/28

Every UK company car has a BIK rate band based on its CO2 emissions and zero emission miles.

To calculate your company car tax, you can multiply your car’s P11D value by the BIK rate percentage (see the table below), then multiply that figure by your tax band i.e. 20% or 40%.

Company Car Tax Benefit in Kind (BIK) Rates Table 2023/24 to 2027/28

This company car tax table shows the UK’s BIK rate bands based on a vehicle’s zero emission miles and CO2 emissions.

If you don’t know your CO2 emissions off the top of your head, no worries! You can find out your vehicle’s CO2 emissions on the Government’s Vehicle Certification Agency portal. You just need your registration date and make/model details and in seconds it’ll spit out your emissions data.

For a quick fix, a car tax calculator, like this one from comcar, will do the hard work for you. This calculator is for new cars but they have an “older cars” solution too, it’s just not so slick so have your registration details and derivative info handy.